Business interruption

cover lost income and extra expenses after fire, flood, or other disruptions. Keep your business running smoothly.

What is Business Interruption Insurance?

Business Interruption Insurance protects your business if you’re forced to close or pause operations due to unexpected events, such as fire, flood, supply chain issues, or restricted access to your premises.

It covers lost income and extra operating expenses, helping you recover quickly and keep your business running even during downtime.

What Does It Cover?

- Loss of Income – Covers estimated profits you would have earned without the interruption.

- Increased Operating Costs – Extra expenses to minimise income loss, such as temporary relocation.

- Supply Chain Disruption – Cover if essential UK suppliers are unable to deliver goods.

- Public Utilities Interruption – For disruptions lasting more than 24 hours.

- Restricted Access – If public authorities prevent you from entering your premises for over 24 hours.

- Health & Safety Restrictions – Such as contamination, food-related illnesses, or pests.

- Ongoing Hire Charges – Covers charges you are legally required to pay during downtime.

Do I need Business Interruption Insurance?

While not legally required in the UK, it is highly recommended for businesses of all sizes. Downtime can lead to serious financial loss – small businesses risk cash flow problems, while larger ones face costly delays and lost revenue.

If your business premises were unusable, would you be able to cover ongoing costs or work elsewhere? This insurance ensures you can stay afloat and recover quickly after an unexpected disruption.

For complete protection, it’s often combined with Office Buildings Insurance.

How Much Cover Do I Need?

Your cover should reflect:

- Your annual revenue and profit levels.

- The time it would take to fully recover from an interruption (e.g., after a fire or major equipment failure).

- Your industry and size of business.

Business Interruption Insurance can also be added to a Professional Indemnity Insurance policy for comprehensive protection.

Need more help?

Our online quote is fast and simple but, if you need help or a wider range of policy options, our team of experts.

Call us today: 020 7846 0108

9am to 5pm Monday to Friday.

Why choose Tapoly?

Accessible Coverage

Get the protection you need, whenever you need it, with our easy-to-use online platform.

Affordable Pricing

Designed to fit your budget, ensuring you’re protected without breaking the bank.

Flexible and tailored

Choose coverage that grows with your business, from professional indemnity to public liability and beyond.

Learn more about Business Interruption insurance

-

Flooding Contingency Planning for Self Employed and Small Businesses

Floods are the most common natural disaster in the UK, and flooding is a major risk of business interruption to firms of all sizes. Don’t think of flooding as something that happens to other people. If you’re not prepared, even…

-

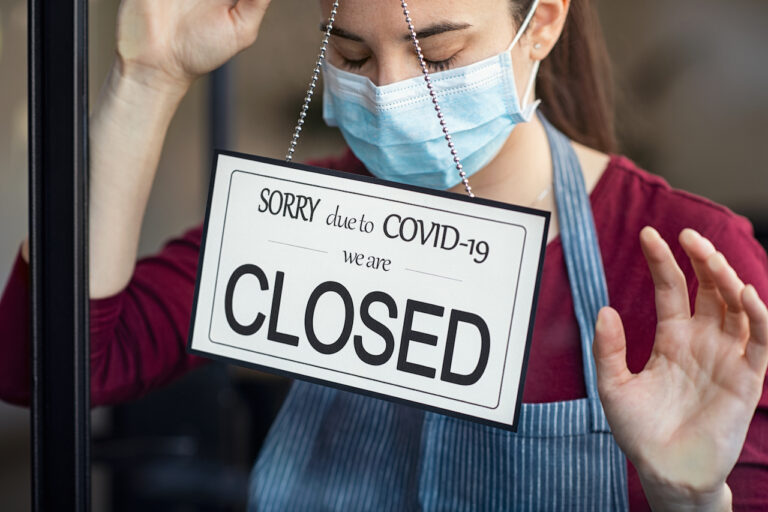

Good News for Small Businesses Impacted by COVID-19

On 15 January 2021, the Supreme Court made an unprecedented decision. It ruled that small businesses affected by the Coronavirus pandemic should have their claims paid under Business Interruption insurance. The judgment was based on a test case brought before…

-

Business Interruption Insurance – 5 Reasons Why You Need It.

You May Be Operating Just Fine Without It But Business Interruption Insurance Might Just Rescue Your Business. Business interruption insurance is a type of cover that many small businesses and freelancers overlook. In truth though, protecting yourself against loss of…